🏢 About Anil Ambani & His Business Empire

Anil Dhirubhai Ambani, born June 4, 1959, heads the Reliance ADA Group (ADAG), which owns key entities like Reliance Power, Infra, Capital, and Communications. Once among India’s wealthiest, Ambani’s net worth has drastically declined amid mounting debt and regulatory scrutiny.

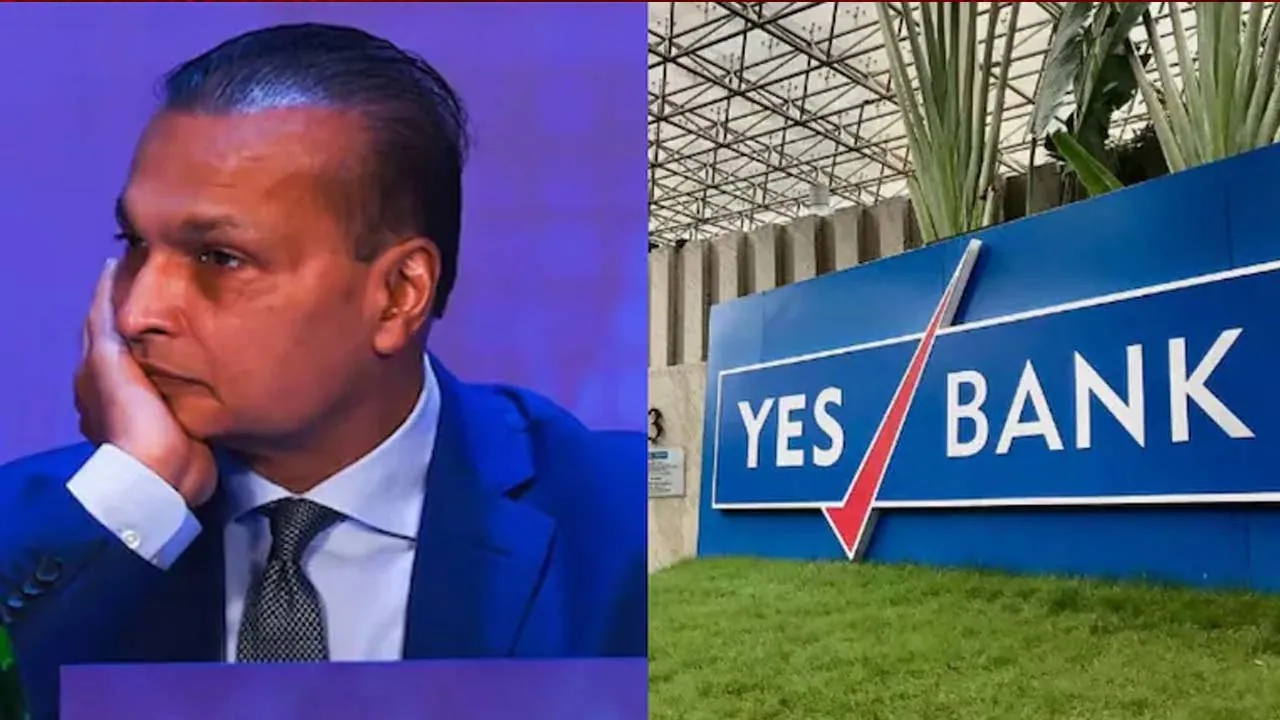

🔍 The Enforcement Directorate’s Major Action

On July 24–25, 2025, the Enforcement Directorate (ED) executed coordinated raids across 35+ premises tied to Anil Ambani and 50 ADAG-linked companies, in connection to a suspected ₹3,000 crore (₹20,000–30,000cr) loan fraud involving Yes Bank loans. Government sources suggest that loans were diverted via shell companies, possibly amounting to widespread money laundering.

📉 Market Fallout

Following the raids:

-

Share prices of Reliance Infrastructure and Reliance Power fell by 4–5% at market open.

-

Market confidence is shaken as investors await clarity on legal and financial repercussions.

⚖️ Regulatory & Legal Backdrop

-

SBI had earlier labeled Reliance Communications’ loan account as fraudulent; concerns over fund misuse resurfaced.

-

In Aug 2024, SEBI banned Anil Ambani and 24 connected entities from the securities market for five years, imposing a ₹25 crore fine for alleged fund diversion from Reliance Home Finance.

-

Ambani is reportedly reviewing legal remedies, including filing before the Securities Appellate Tribunal (SAT).

🕵️ Recent Developments & Strategic Moves

-

Last week, Adani Group acquired Ambani’s 600 MW Butibori power plant for ₹4,000 crore under insolvency resolution—adding to ADAG’s shrinking asset base.

-

Meanwhile, Reliance Defence Ltd. continues expansion,

including tie-ups with Germany’s Rheinmetall for ammunition production and aircraft assembly in Nagpur—although these business lines are overshadowed by legal uncertainties.

❗ Why This Matters

-

The current probe reflects deep institutional concern over possible systemic misuse of loans and public funds.

-

With Anil Ambani’s subsidiaries under scrutiny, investor sentiment remains fragile.

-

The rounded-down legacy of once-leading entrepreneurial success highlights how corporate missteps and debt burdens can erode even well-established business empires.

✅ Final Take

Anil Ambani, once a top-tier industrialist, now faces intensified regulatory action. The ED raids and market response signal a pivotal moment in corporate governance and financial justice. As investigations unfold, media and investors will closely watch how ADAG firms defend themselves and what this means for stakeholder trust.

Follow Akhbaar Express for more!